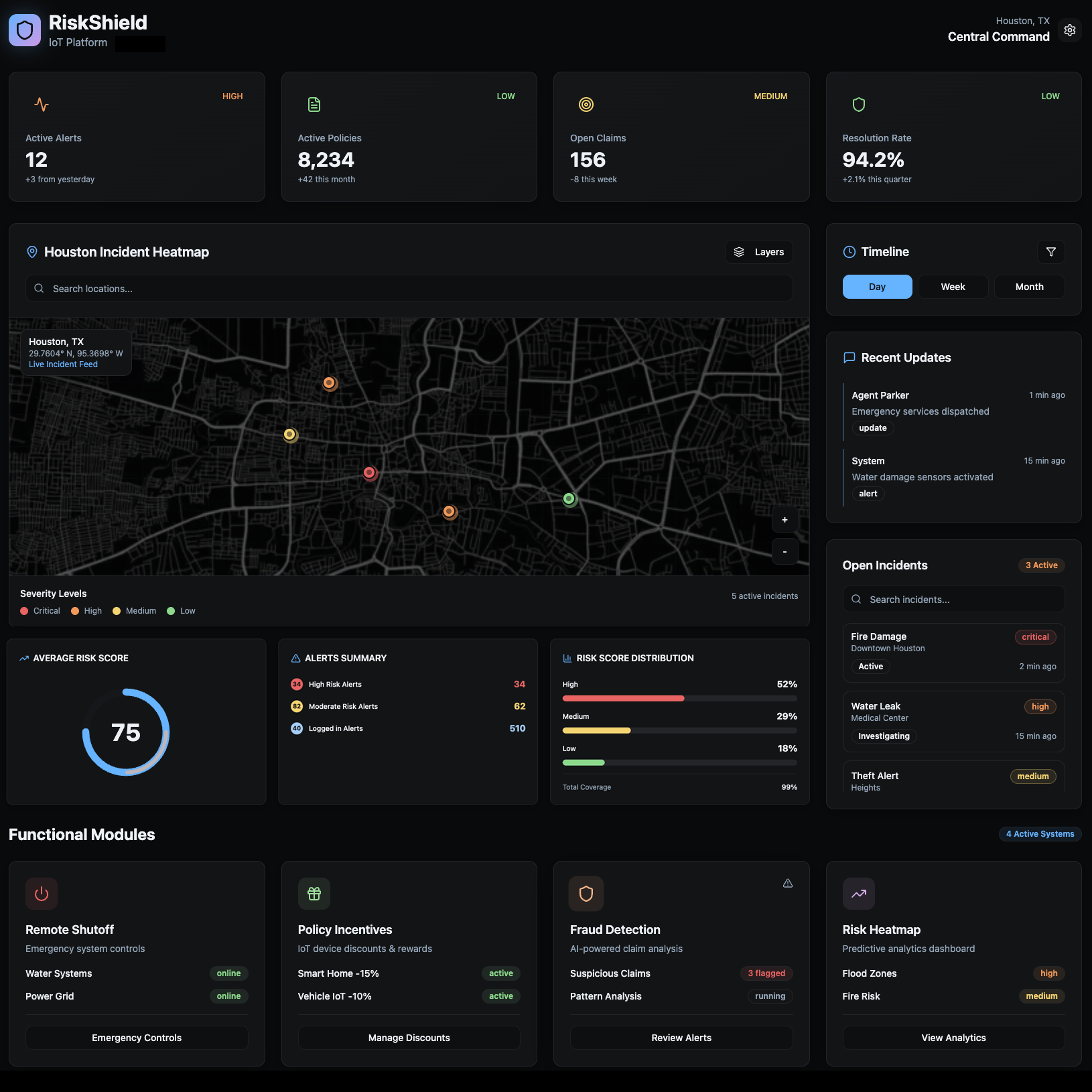

Risk Shield

Predict risks. Prevent losses. Protect what matters.

Working with a large insurance provider, we built an IoT-powered monitoring platform designed to stop incidents before they happen — and accelerate claims when they do.

The Challenge:

Insurance is traditionally reactive. Customers only engage when filing a claim — often after damage has already occurred.

-

Rising claims costs were eroding margins.

-

Settlement delays frustrated policyholders.

-

Lack of proactive touchpoints made insurers feel distant and commoditized.

The Solution:

Ship Street created Risk Shield, a next-generation insurance ecosystem that combines IoT and AI to shift insurance from reactive payouts to proactive protection.

At its core, the platform integrates smart sensors in homes, vehicles, and workplaces with a real-time anomaly detection engine. When risks such as water leaks, fires, intrusions, or unsafe driving behaviors are detected, Risk Shield immediately alerts the customer, offers actionable interventions (like remote shutoff), and updates the insurer with contextualized data.

Behind the scenes, AI-powered triage accelerates claims by automatically categorizing incidents, routing simple cases to instant approval, and flagging complex or suspicious cases for human review. A predictive analytics dashboard gives insurers visibility into emerging risk patterns and the financial impact of prevention, while policyholders receive incentives, tips, and rewards for safe behavior.

The result is an ecosystem where customers feel protected and supported every day — not just when something goes wrong — and insurers benefit from lower claims costs, faster resolutions, and stronger customer loyalty.

25%

Fewer claims filed in sensor-enabled households

60%

Faster resolution for minor incidents

18%

Higher retention among digital policy holders

Prevention Layer

IoT sensors for homes and vehicles continuously monitor for leaks, fire, intrusion, or risky driving.

Claims Acceleration

An AI triage engine fast-tracks simple claims for same-day resolution, escalating only complex cases to human adjusters.

Insights & Incentives

Dashboards predict losses, while behavioral nudges and premium discounts reward proactive prevention.

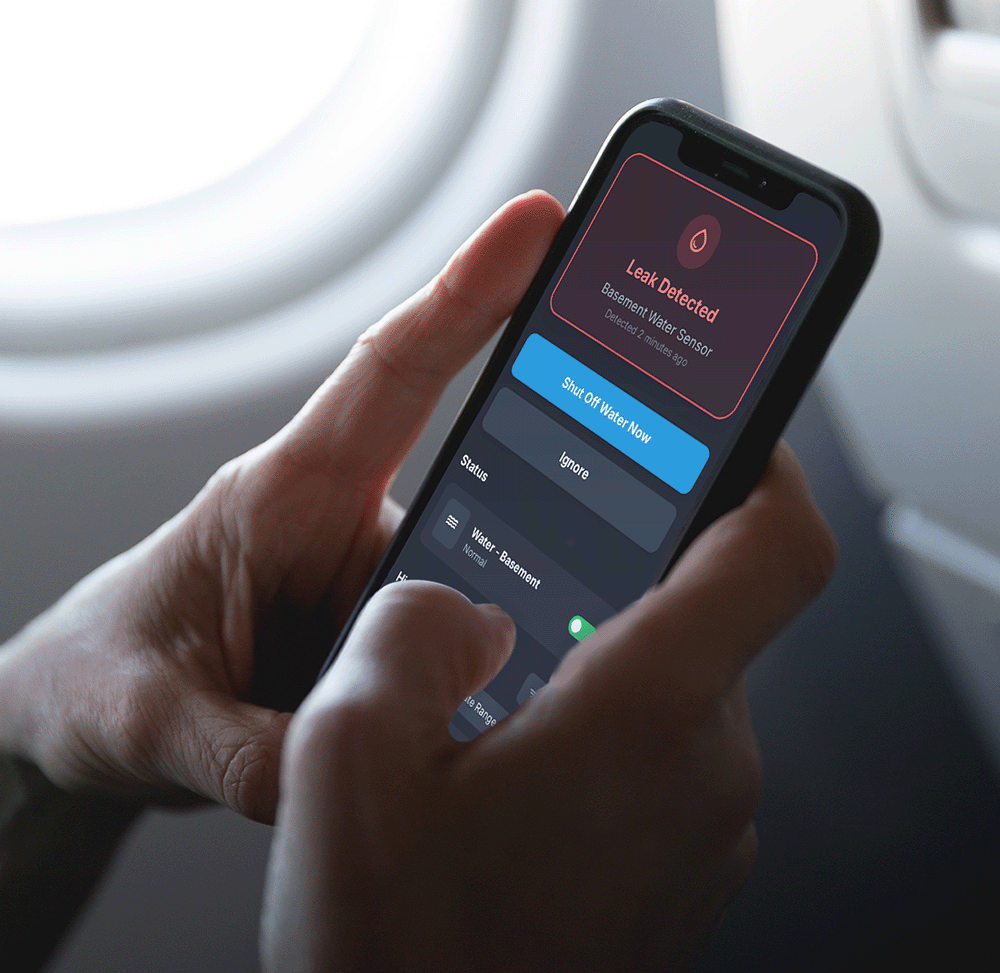

Remote Shutoff

Risk Shield empowers customers to take immediate action when incidents occur. With one tap, they can remotely shut off water or power, preventing what might have become a costly disaster.

This simple feature transforms emergencies into manageable events, saving both the policyholder and insurer significant losses.

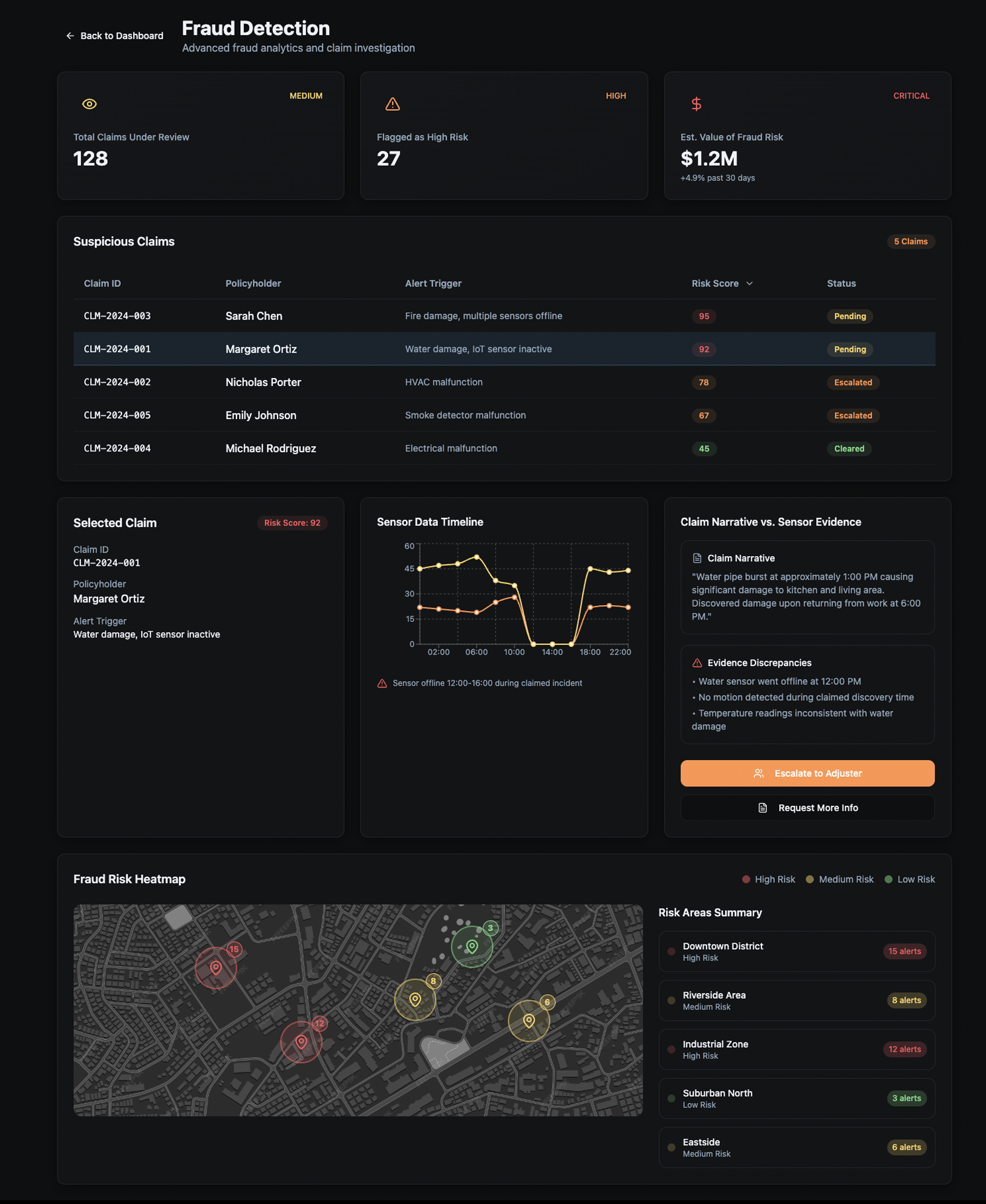

Fraud Detection

Behind the scenes, Risk Shield uses AI to continuously cross-check claim narratives against IoT sensor data and behavioral patterns.

Suspicious discrepancies are flagged before they escalate, allowing insurers to act swiftly and fairly. This proactive detection not only protects the insurer’s bottom line but also strengthens trust with honest customers.

Claims Chatbot

Filing a claim becomes as easy as texting a friend. The SureSense chatbot pre-fills incident details using IoT data and guides customers through the process step by step, available anytime, day or night.

The result is faster, more accurate claims with minimal effort from the customer.

From Idea to Impact

Explore

Aligned insurer priorities and mapped high-value use cases.

Sprint

Prototyped customer journeys and validated with real users in four weeks.

Build

Integrated with IoT vendors and claims admin systems.

Launch & Learn

Piloted with 3,000 households; refined AI triage engine.

Scale

Playbook for rollout across markets and new product lines.

Ready to build something extraordinary?

LET’S GET STARTED

hello@shipstreet.ventures